Market Data Bank

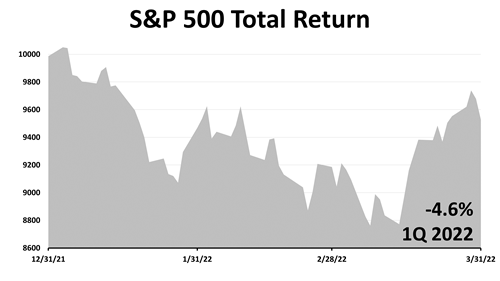

S&P 500 WIN STREAK SNAPPED

Snapping a seven-quarter win streak, stocks suffered a -4.6% loss in the first quarter of 2022. The last losing quarter for the S&P 500 was the first quarter of 2020, when the pandemic wiped out 20% of the value of stocks. Inflation is at a 40-year high and Ukraine invasion has sent oil prices skyrocketing, hurting stocks.

A 12-MONTH WALL OF WORRY

Despite the first quarter loss of -4.6%, the S&P 500 stock index over the five years ended March 31, 2022, showed a total return, including dividends, gained +110%. The five years included the pandemic market meltdown of February and March 2020, when the stock market lost -34% of its value.

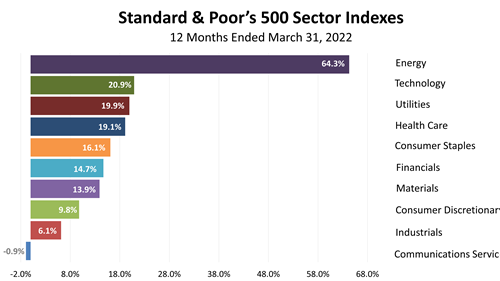

INDUSTRY SECTORS

Rising oil prices fattened profits, sending energy company stocks soaring in value by +64.3%! American energy companies could benefit from a European ban on Russian natural gas and oil, but it will take months for U.S. energy companies to ramp up oil production and exports of natural gas.

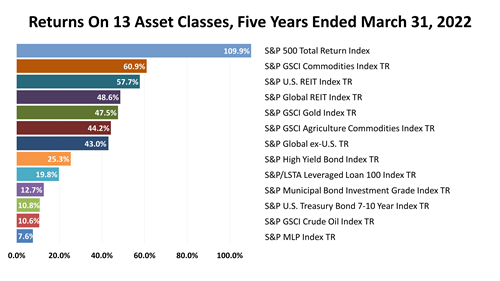

INDEXES TRACKING 13 ASSET CLASSES

Of the 13 asset classes represented by indexes, oil was No. 12 over five years — despite its recent surge. Master limited partnerships, heavily weighted in the energy sector, was the worst of this diverse group. The top performer of the broad array of assets was U.S. stocks.

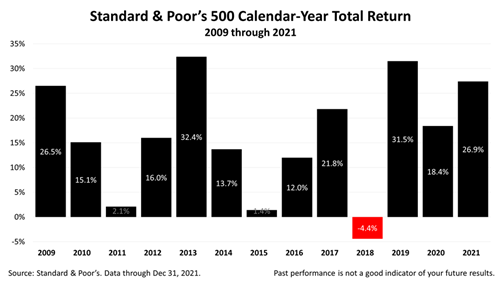

PERSPECTIVE ON THE 1Q22 LOSS

The 10-plus year expansion that erupted after the global financial crisis of 2008 was a period of spectacular calendar-year gains, and it was followed by three great years in 2019, 2020, and 2021. This puts the first-quarter loss of -4.6% on the S&P 500 stock index in proper perspective.

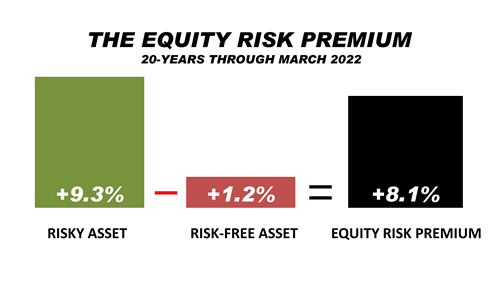

YIELD CURVE

U.S. stocks are always risky. That’s why they paid a premium over riskless Treasury Bills in the 20-years shown, encompassing three frightening bear markets in 2002, 2008, and early 2020. Past performance is no guarantee and that, paradoxically, is precisely why investors are paid a premium for owning stocks.

Past performance is never a guarantee of your future results. Indices and ETFs representing asset classes are unmanaged and not recommendations. Foreign investing involves currency and political risk and political instability. Bonds offer a fixed rate of return while stocks fluctuate. Investing in emerging markets involves greater risk than investing in more liquid markets with a longer history.