Market Data Bank

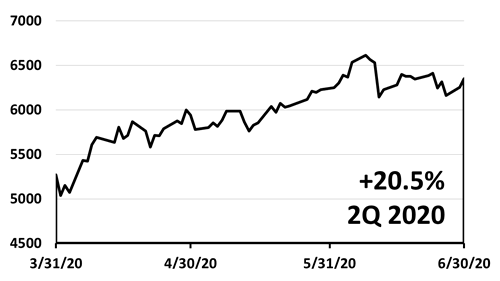

S&P 500 RECOVERED SHARPLY IN 2Q 2020

This was the COVID quarter, and the nation suffered the worst kind of loss. By the end of 2Q20, 125,000 lives were lost to COVID-19 in the US. The +20.5% S&P 500 return in 2Q20 does not reflect the -33.9% plunge in 1Q2020 from the all-time high in the S&P 500 on Feb. 19, 2020 to the Mar. 23, 2020 bear-market low.

U.S. STOCKS DOMINANT OVER FIVE YEARS

The S&P 500 has trounced returns of major regions and emerging markets across the globe, this is just a five-year snapshot. The outperformance of the U.S. economy and stock market actually began in early 2009 and drove the long bull market that ended with the Covid bear market that bottomed March 23, 2020.

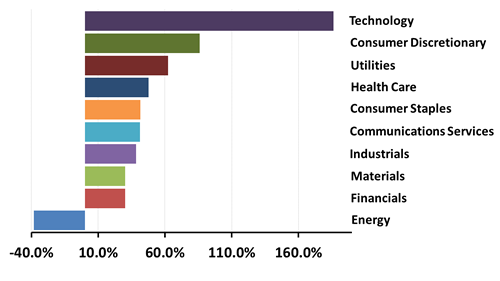

ENERGY WAS WORST SECTOR IN Q1 & Q2

Energy stocks lost half their value in 1Q 2020 and another -38.2% in Q2. With stay-at-home orders in effect across the globe, the world oil glut worsened. Meanwhile, U.S. Government stimulus - $1200 checks, plus $600 a week of extra unemployment insurance benefits, boosted consumer spending.

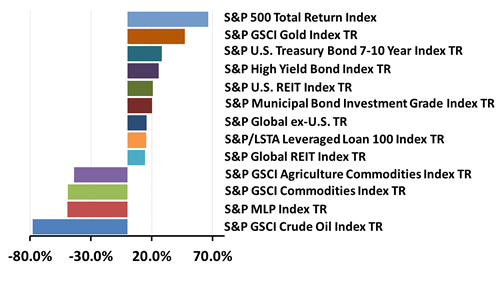

INDEXES TRACKING 13 ASSET CLASSES

In the immediate aftermath of the Covid-19 bear market, the five years ended June 30, 2020, the S&P 500, the growth engine of a diversified portfolio, was the No. 1 investment across a broad range of 13 assets. Even after the coronavirus bear market, the five-year return of +66.5% wasn't terrible for the S&P 500.

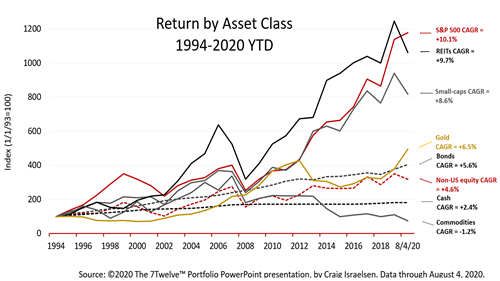

ASSET RETURNS OVER 25 YEARS

Interest rates are low, the Fed says it does not expect to raise interest rates anytime soon, and stocks are fully valued. This could push money into gold, which is a small asset class relative to stocks. Even a small shift of capital from stocks or bonds could drive up the price of gold.

CONSENSUS FORECAST

Facebook, Apple, Amazon, Netflix, Google, and Microsoft, have the most influence on the broad S&P 500 composite, and those are the very companies that were growing fastest through the recovery from the pandemic, which magnified their influence on the S&P 500, in propelling the stock market in 2Q 2020.

Past performance is never a guarantee of your future results. Indices and ETFs representing asset classes are unmanaged and not recommendations. Foreign investing involves currency and political risk and political instability. Bonds offer a fixed rate of return while stocks fluctuate. Investing in emerging markets involves greater risk than investing in more liquid markets with a longer history.